2023

After a very different sort of year in 2022, much of the market was caught off guard in 2023 by a showstopping performance from the share prices of a handful of technology companies. The surge of the Magnificent Seven1 propelled markets higher but such gains were not widely shared. In fact, 72% of the remaining 493 constituents of the S&P 500 underperformed the index as a whole, as did many actively managed equity funds.

We were impressed by the extent of economic strength last year but not surprised that tighter monetary policy is taking time to be felt. The Trust delivered a modest, positive return for the year whilst upholding a cautious portfolio allocation to risk. Equities drove around half of the return, whilst our government bonds (mostly short-duration and index-linked) and gold exposure contributed positively to performance.

Our mandate of capital preservation requires that we alight the bull market train well before it becomes derailed. Longstanding investors will know that this primary objective is closely followed by a secondary objective to generate strong returns ahead of inflation over the long term. As a result, investors in this strategy should be prepared for our allocation to equities to shift substantially higher in the future from the c. 25% of the portfolio invested in stocks today. This will happen when we judge that shareholders are being adequately compensated for the risks that they face.

Tightrope walking

Today does not offer such an opportunity. Most might disagree, as suggested by various barometers of investor sentiment. The ‘American Association of Individual Investors’ (AAII) Sentiment Survey showed that at the start of January 2024, less than a quarter of investors surveyed were bearish compared with nearly 50% at the start of 2023. But following the rally in equities during the final two months of 2023, we believe that stock markets are walking a tightrope. Consensus is for the best possible outcome of an economic soft landing accompanied by six interest rate cuts in the US this year. In other words, equities are priced for the most benign scenario. The risks to this are all to the downside.

We enjoyed an article published last year by Ed Yardeni entitled ‘Nothing to Fear but Fearless Investors’. With every month that passes without a recession, investors become more fearless. Ironically, it is the very passing of time which brings a downturn closer. The average lag between the final rate hike in 1989, 2000 and 2006 and the recessions that followed was c. 15 months. In this cycle, the Federal Reserve enacted what looks likely to have been its last rate hike in July 2023. On that basis, one could reasonably expect a recession to start towards the end of 2024. However, to the market’s mind the historical precedent is no longer relevant; the Fed has signalled that it will begin lowering rates in response to lower inflation so, the thinking goes, a soft landing is all but assured.

In response to the Fed’s apparent willingness to ease interest rates, the 10-year US Treasury bond yield fell -60bps from November to December, the steepest fall since 2008. The loosening of financial conditions propelled both bonds and equities higher. The bond market is now pricing in nearly 1.5 percentage points of rate cuts this year. The Fed’s ’Dot Plot’ shows that members of the rate-setting committee itself are, on average, only expecting to lower rates by 0.75 percentage points (or to enact three interest rate cuts of 25bps) this year. Past experience suggests that both forecasts will be wrong but, when it comes to the all-important expectations of the market, there is ample room for disappointment.

We read with interest an interview published by the FT in December with economist and former US Treasury Secretary Larry Summers. Therein he set out the possibilities which lie either side of a soft landing:

“So at this point, we may soft land on the aircraft carrier, but the landing may be hard, and we may overfly. That said, if by a soft landing one means a period when you have inflation above 4 per cent and unemployment below 4 per cent, and you extricate from that situation without a recession — that’s something that’s never happened before in the United States and for which there’s very little precedent in the industrial world. And it certainly looks in play as a possibility, though I think it’s a long way from assured.”

In our view, for the Federal Reserve to ease monetary policy to the extent expected by markets, the economic environment is going to have to get a lot more challenging. Having been too late in addressing inflationary pressures in 2021, it seems to us unlikely that the world’s most influential central bank will gamble its credibility by cutting rates too early. The instance in which it does enact six or more rate cuts is unlikely to be one where earnings are growing nearly +10%, which is the consensus level for S&P500 earnings growth in 2024. Thus, we remain concerned that there are two ways to lose in equities – 1) via higher than assumed interest rates, leading to a higher cost of capital for stocks, and thus lower valuations or 2) via lower earnings. We may well experience one followed by the other.

Deep pockets

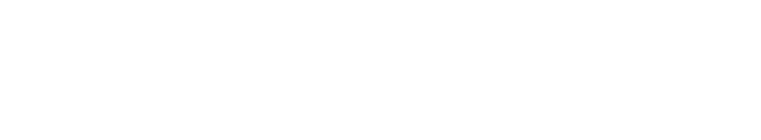

The US government is spending money like it’s going out of fashion. This has provided a great fillip to growth. The fiscal deficit (the amount by which government expenditure exceeds receipts) was $1.3trn for the first three quarters of 2023, or nearly 5% of GDP. We have never seen this level of government spending outside of a recession or its immediate aftermath. On a gross basis, the fiscal outlay relative to the size of the economy is approaching a level consistent with the peak in government support provided during the Second World War (Figure 1).

Figure 1 – US GOVERNMENT EXPENDITURES (% GDP)

Source: Bank of America Merrill Lynch, January 2024

The phenomenon is consistent with a multi-decade long trend and is not unique to America. It is both a symptom and a cause of lower pain thresholds on the part of electorates around the world. We expect that the next recession will see a fiscal response on top of a monetary one, such that the benefits extend beyond owners of capital to labour as well. This, as we saw with COVID, is likely to mean inflation for goods and services on top of asset price inflation. Governments’ increased readiness to respond to economic hardship will help define the shape of the next recession and subsequent rates of inflation.

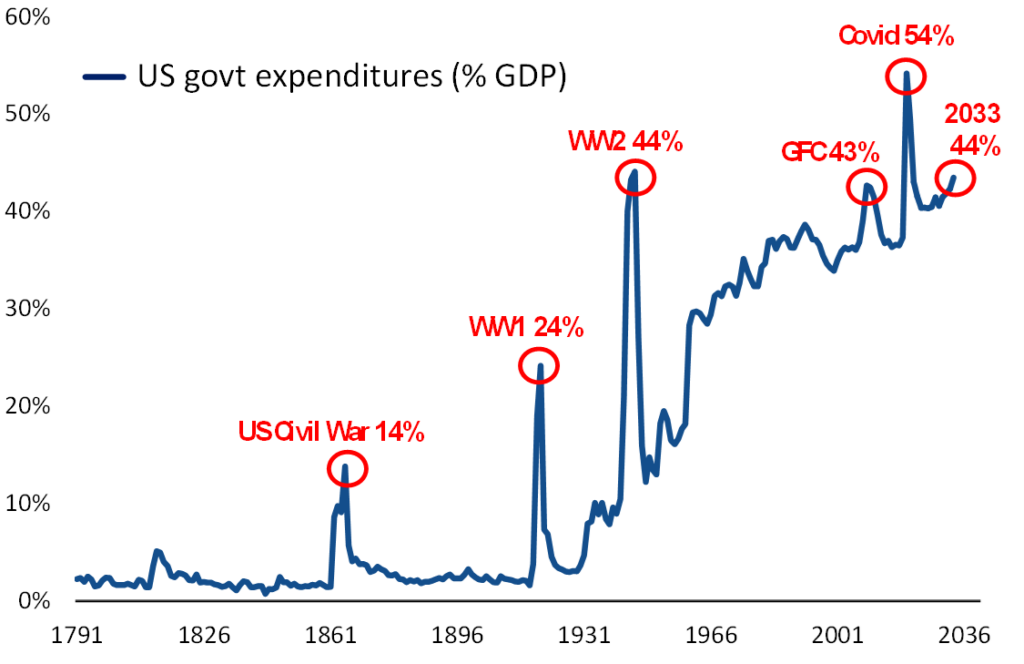

Recessions aside, the current chapter of enlarged fiscal spend has been driven by two ongoing agendas. The first is that of decarbonisation, with fiscal incentives in the US provided through the (unfortunately named) ‘Inflation Reduction Act’. The second is that of reshoring supply chains. This is happening around the world on the back of growing nationalism. In the US it is most evident through the building of semiconductor manufacturing capability, incentivised by the CHIPS Act. The latter has been a key driver behind the doubling of US manufacturing spend since last June (Figure 2). The two spending plans together amount to $650bn committed over the next decade, with similar initiatives in place in Europe.

Figure 2 – US construction manufacturing spend (ANNUALISED RUN-RATE, $M)

Source: Bloomberg, January 2024

How to fund it

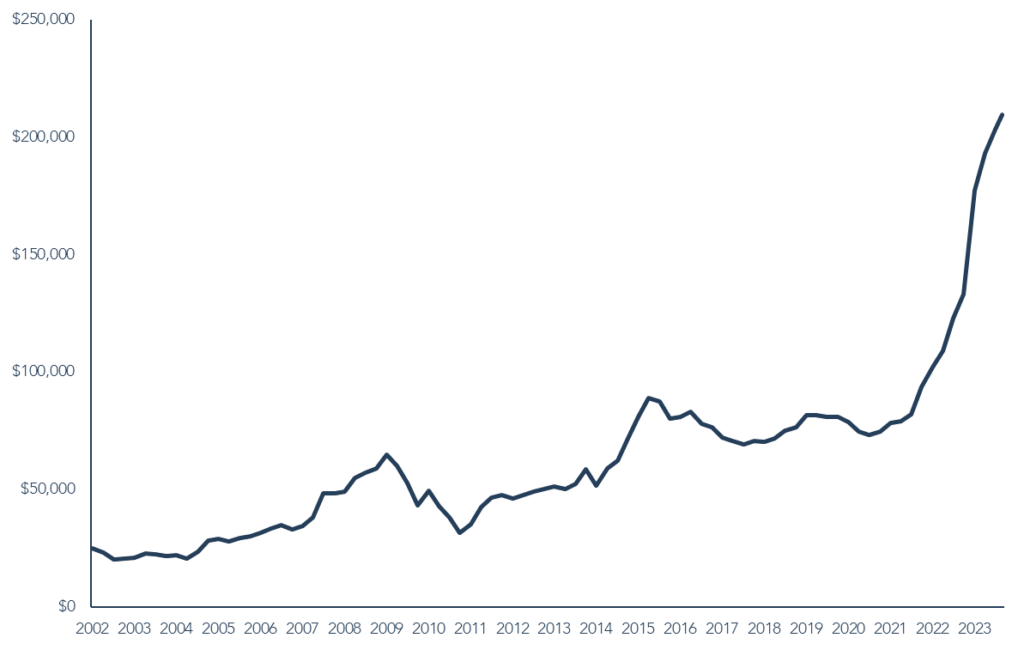

For many governments, the US included, there is however a burning question around the affordability of the resultant expansion in government debt. This was not a problem when interest rates were near-zero. However, the government is now spending over 14% of its revenues on interest, up from around half that rate in 2015. The US government was less savvy than many of the world’s debt-issuing corporates. Instead of locking in low rates in 2021 via longer-duration maturities, the US Treasury issued short-dated paper which will soon need to be refinanced. Figure 3 illustrates this precariously front-end loaded maturity profile. If rates stay where they are, the interest cost is projected to reach 25% of revenues in a few years’ time. The costs of government borrowing risks crowding out more productive uses of capital and lowering future economic growth rates.

Figure 3 – US marketable Treasury securities by calendar year of maturity

Source: US Treasury, Jefferies, 31 December 2023.

The problem may worsen as the government debt burden undermines investor confidence, pushing yields up further. Fiscal retrenchment (higher taxes, lower spending) is one possible way out of this quandary, but governments are unlikely to choose such an unpopular path if they can help it. More likely in our view, is that real rates fall to more affordable levels from here. This can happen either via a more permissive approach to inflation (i.e. allowing for inflation to stay at more elevated levels), or via a lowering of nominal rates. If inflation is persistent, as we suspect it will be, it is likely that real rates will fall, but with nominal rates staying above the 2010’s levels to which investors have become accustomed.

From top to bottom

As we look to the year ahead, we do not attempt to make precise economic or market forecasts. We also believe it would be imprudent to make investment decisions on any such basis. Instead, we consider valuations, risk and prospective returns for every asset class we invest in. We believe that the scope for disappointment in the equity market today demands caution, but we must be ready to turn on a sixpence when prices come our way. We have the dry powder and the flexibility to be able to act dynamically, as we have in previous market cycles, and the course of action will be rooted in an understanding of the companies we favour, tempered by an awareness of the macroeconomic risks they face.

We also remain alive to opportunities as they present themselves. One such example is alcoholic beverages where, in the past few months, we have started a holding in Heineken. Following inflated operating costs, and revenue headwinds in some of its emerging markets, the shares had de-rated to multi-year lows. Heineken is well-known to Troy, having been owned in the Troy Global Equity Strategy for over a decade. As the valuation of the shares became more attractive in 2022 and 2023, the team conducted further research on the company. This, alongside meetings with management, confirmed our enthusiasm for Heineken and its position within the attractively growing segment of premium beer.

Our approach to buying shares in Heineken, ably supported by the rest of the team at Troy, provides a microcosm of how we work. Our collective knowledge of a group of exceptional companies offers valuable clarity when it comes to managing our equity exposure. Opportunities may stand alone, as in the case of Heineken, or become more pervasive across the market. The ability to anchor market expectations in an understanding of individual businesses lends substantial conviction to our decision-making. This will remain vital as we enter into what we believe will be a more challenging period for equities.

1 Each stock in this group — Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla — delivered gains of +48% or more in 2023.

2 Each week the AAII asks its 170,000 members whether they are bearish, bullish or neutral

3 The Fed’s Dot Plot is a chart updated quarterly that records each Fed official’s projection for the central bank’s key short-term interest rate, the federal funds rate.

Please refer to Troy’s Glossary of investment terms here.

Performance data relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the investments will be met. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation.

Please note that the Personal Assets Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training.

© Troy Asset Management Limited 2024