“Betting against gold is the same as betting on governments. He who bets on governments and

– Charles de Gaulle

government money bets against 6,000 years of recorded human history.”

Our aim at Troy has always been to preserve our investors’ hard-earned capital and increase its value in real terms over the long term. Since being appointed Investment Adviser to Personal Assets Trust (‘PAT’) in March 2009, physical gold has played an important role in achieving this objective for the Trust, generating a compound annual share price return of 7% (in GBP terms)1.

This paper sets out why we own gold, the role it plays in portfolios and how we weight it against other asset classes.

Why gold?

Gold is unique in its durability and resilience. It is a currency that has survived millennia and proved to be a rare store of value in an ever-changing world.

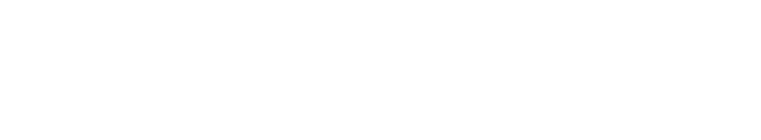

Gold’s lasting value is linked to its physical attributes. Gold is chemically inactive, virtually indestructible and, unlike other resources, is not depleted through use or wear. There is also a finite amount of gold in the ground, rendering gold’s supply remarkably stable. Mined gold in any one year typically amounts to approximately 1.8% of the overall above-ground stock.2 Contrast this with the expansion of money supply (Figure 1) and gold’s merits as a supply-constrained currency are compelling. Gold exists outside of the financial system and is no one’s liability. Fiat currencies exhibit an inherent fragility linked to the fiscal and monetary prudence of the issuing government. The unorthodox monetary policies of Central Banks following the global financial crisis, including zero interest rates and quantitative easing, coupled with greater fiscal largesse since the pandemic, suggests such prudence is in short supply. Unorthodox policies are easily entered into but only ever exited with difficulty. As Milton Friedman insightfully said, ‘nothing is so permanent as a temporary government program’! The credibility of fiat currencies can be shattered overnight, as we have seen in the case of several emerging market currency devaluations (e.g. Turkey, Nigeria and Argentina), or it can be eroded gently, as has occurred in much of the developed world.

Gold’s intrinsic value is difficult to ascertain but the rise in the gold price parallels the debasement of fiat currencies over the long term. The widespread acceptance of gold as a store of value is time-tested and likely to persist. Gold has been a safe haven for thousands of years, making it more likely that it will continue to be so for a long time to come. In many respects, gold is a perfect example of the Lindy effect, which proposes that the longer something has survived, the longer its remaining life expectancy is likely to be.

These attributes combine to make gold an asset that provides real diversification benefits to an investment trust seeking to avoid the permanent impairment of capital.

FIGURE 1 – ANNUAL GOLD SUPPLY AND THE EXPANSION OF US MONEY SUPPLY (M3) SINCE 2006

Source: Troy Asset Management Limited, Bloomberg, World Gold Council, December M3 is a collection of the money supply that includes M2 money as well as large time deposits, institutional money market funds, short-term repurchase agreements, and larger liquid funds.

What role does gold play in a portfolio?

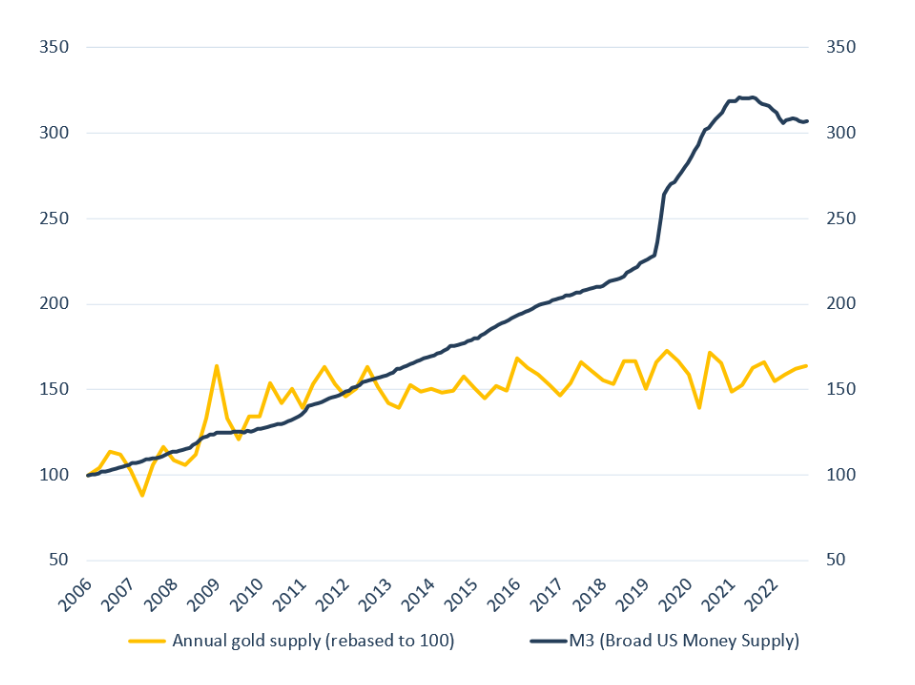

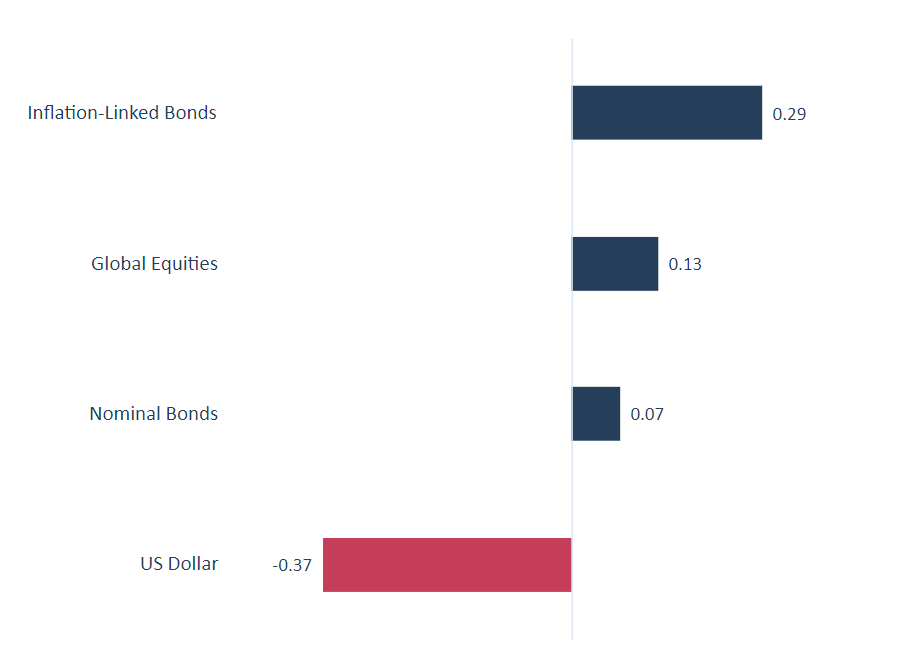

Gold acts as a valuable diversifier in PAT and is essential portfolio insurance. A lack of industrial utility and its status as a safe haven mean that gold is not economically sensitive and has a low correlation with other asset classes (Figure 2). Gold’s correlation with equities also typically declines during periods of market stress (Figure 3), giving gold an antifragile3 quality that supports the preservation of capital.

FIGURE 2 – GOLD HAS LOW CORRELATION TO OTHER PORTFOLIO ASSET CLASSES

Source: Bloomberg, 31 December 2023. Correlations based on weekly USD price returns since 31/12/1974 (30/04/1998 for Inflation Bonds). Global Equities = MSCI World (MXWO Index). Dollar = Dollar Trade-Weighted Index (DXY Index). Nominal Bonds = Bloomberg US Treasury Index (LUATTRUU Index). Inflation-Linked Bonds = Bloomberg US Treasury Inflation Notes Index (LBUTTRUU Index).

FIGURE 3 – GOLD & MSCI WORLD INDEX CORRELATION SINCE 1975

Source: Troy Asset Management, Bloomberg, 31 December 2023. Past performance is not a guide to future performance. Correlations based on weekly USD price returns since 31/12/1974.

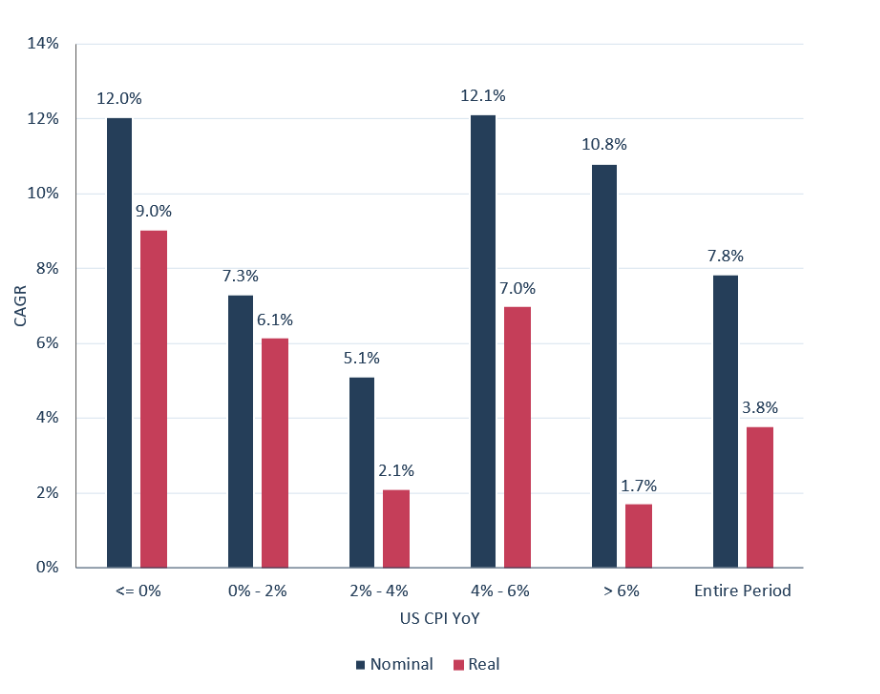

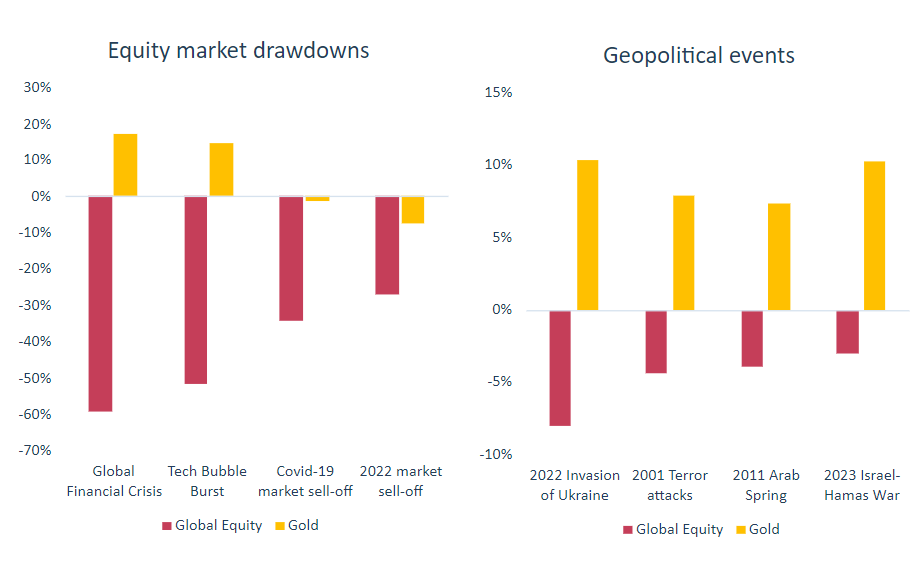

We do not try and predict short-term fluctuations in the price of gold. However, we do believe that gold provides strategic long-term insurance for the trust. This belief is supported by gold’s track record across a wide range of environments. Gold has played a role in preserving capital in periods of inflation, deflation, during wars and conflicts, and at times of financial market stress (Figures 4 & 5).

FIGURE 4 – COMPOUND ANNUAL GROWTH RATE (CAGR) OF GOLD DURING DIFFERENT INFLATIONARY REGIMES (1970-2023)

Source: Troy Asset Management, Bloomberg, 31 December 2023. Past performance is not a guide to future performance.

FIGURE 5 – GOLD DURING EQUITY MARKET DRAWDOWNS AND GEOPOLITICAL EVENTS

Source: Troy Asset Management, FactSet, 31 December 2023. Gold in USD. Past performance is not a guide to future performance.

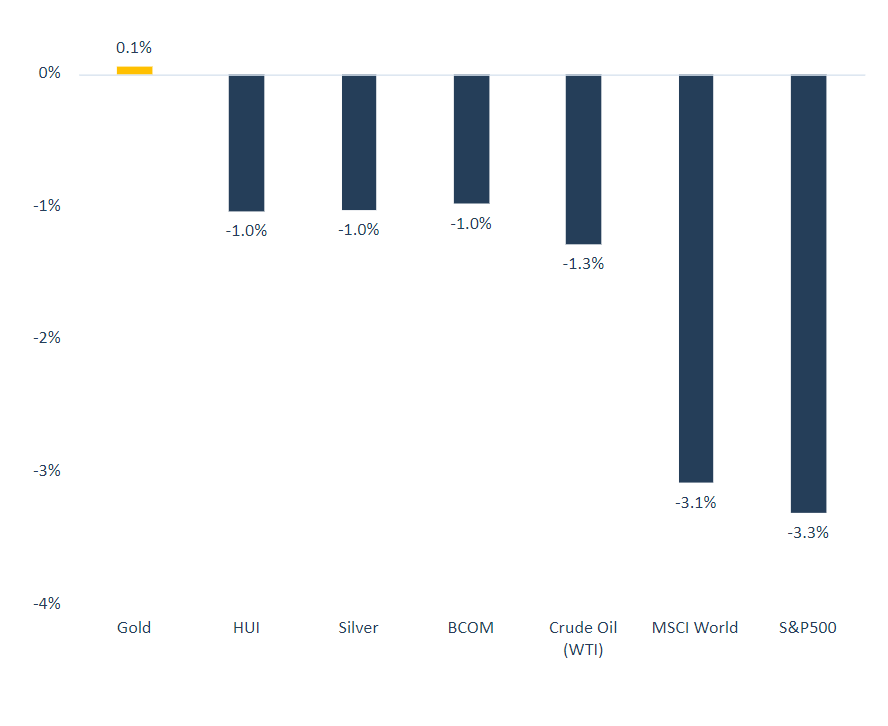

When investor faith in risk assets weakens, gold has tended to perform well. Figure 6 shows the average performance of gold, and other assets, during the worst 20% of weeks for the S&P 500 Index since 2000, displaying the defensive characteristics we seek.

FIGURE 6 – AVERAGE PERFORMANCE DURING WORST 20% OF WEEKS FOR S&P 500 INDEX SINCE 2000

Source: Bloomberg, 30 June 2023. Past performance is not a guide to future performance. HUI is the Bloomberg ticker for the NYSE Arca Gold BUGS Index. BCOM is the Bloomberg ticker for the Bloomberg Commodity Index. Troy multi-asset portfolios started investing in gold bullion in January 2005 at $424 per Troy/ounce. All references to benchmarks are for comparative purposes only. All references to other assets are for comparative purposes only.

Other assets can play a valuable role in a portfolio but few support resilience in as broad a range of environments as gold. For instance, cash and government bonds can help dampen volatility and make a portfolio more defensive in times of stress but do little to protect against the erosion of wealth during periods of inflation, or when interest rates rise rapidly from multi-decade lows, as they did in 2022-2023. Commodities often perform well when inflation is rising but are economically sensitive and suffer when there are deflationary shocks. The US dollar typically strengthens when there is uncertainty, benefiting from its safe haven status, but remains a fiat currency with all that that entails.

Gold’s multi-functionality, in a portfolio context, is an attractive trait given the impossibility of accurately predicting the future, or how financial markets will specifically react to new developments. This reality, as well as our commitment to simplicity and long-term investment focus, is why we avoid financial forms of portfolio insurance, including derivatives. Derivatives are tactical and binary in nature, and require you to buy and sell them in a timely manner. Such financial instruments may offer outsized returns when you’re right but add complexity and can bleed a portfolio of performance from high incremental costs, should you wish to own them for any great length of time.

Rather than paying a premium for costly insurance, in the hope that it provides the required protection when needed, we much prefer the return profile offered by gold. Owning gold has allowed us to invest with a long-term mindset, adding robustness to PAT and supporting performance. Over the course of our ownership, gold has delivered a compound annual share price return of 7% (in GBP terms)4. As importantly, gold has performed well at extremes, providing protection when the portfolio has most needed it. It is an insurance policy that we have been paid to hold.

How do we gain gold exposure?

Since 2012, on average, we have held c.11% in gold-related investments. Over the last decade, the portfolio’s gold exposure has ranged from a low of approximately 8% to a high of around 12%. Whilst not an exact science, enough gold is required to provide sufficient downside protection. However, too much and one risks substantially skewing the performance of the entire portfolio during periods of gold weakness. Owing to gold’s status as a currency, and consequently greater reliance on perception, episodes of underperformance can be self-perpetuating and last longer than expected. For example, from its peak in 2011 to its nadir in 2015, the price of gold fell c.-45% in USD terms (c.-41% in GBP), a large enough fall to have derailed performance if gold exposure was too high. Historically, gold has also struggled to perform during periods of high real interest rates. More recently, Personal Assets Trust’s gold exposure helped dampen volatility during the pandemic and in 2022, when global equities sold-off aggressively.

Summary

Gold has been a positive contributor to PAT’s returns over the long term, generating a strong compound return whilst also enhancing the resilience of the portfolio during times of stress. The price of gold will wax and wane but over time gold has proved to be a rare store of value across a broad range of environments. Whilst other currencies are steadily devalued, gold has stood the test of time. Although we don’t try to predict short-term moves in the price of gold, gold provides real diversification benefits and plays an important role in helping us preserve and grow our investors’ hard-earned capital over the long run.

1 Compound annual return of the gold price from March 2009 to March 2024.

2 Source: World Gold Council

3 Antifragility is a concept developed by Nassim Taleb, which describes the ability to not only withstand stress and adversity but thrive under such conditions.

4 Compound annual return of the gold price from February 2005 to January 2024.

Please refer to Troy’s Glossary of Investment terms here.

Performance data relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the

investments will be met. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness.

The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation.

Please note that the Personal Assets Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

All references to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2024. ‘FTSE ®’ is a trademark of the London Stock Exchange Group companies and is used by FTSE under licence. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or

training.

© Troy Asset Management Limited 2024.