Mixed Messages

The past few weeks are confirmation, if any was needed, that there are consequences of rapidly raising interest rates from a base of zero. But even as the evidence appears stacked to the downside, the jury remains out when it comes to many asset prices. Outside of the financial sector, equity markets have generally shrugged off a slew of banking failures in March, the most significant since the Financial Crisis. Silvergate was followed by Silicon Valley Bank (SVB) and Signature in the US and then Credit Suisse in Europe. At the end of 2022, these entities had combined assets on their balance sheets of approximately $900bn. Their fate may not presage another large-scale banking crisis, but their failure tells us something important about the state of the world. Personal Assets Trust has shown resilience during the quarter, delivering a positive return and holding up strongly when markets were at their most volatile.

These events are the latest dominoes to fall in what is proving to be a highly unusual cycle for both financial markets and the economy. Setting the tone for central banks around the world, the US Federal Reserve has raised its overnight lending rate from 0.25% to 5% in only twelve months. This marks the fastest rate hiking cycle in over forty years, on the back of a period during which access to capital had never been easier. The full extent of what this means for consumers, businesses and investors is still unknown, and the outlook is complicated by the economic and psychological consequences of the pandemic. COVID and its attendant policy response have produced a highly unusual confluence of factors which make today’s outlook especially hard to predict. In the words of Janet Henry, Chief Economist at HSBC, ‘It is hardly surprising that this is no normal cycle where all the major components roll over within a month or two of each other’.

The parts of the global economy which are currently driving growth owe much of their strength to the post-COVID recovery. This is particularly true of the US consumer, although at the current rate of spending, US consumers are on course to run down their excess savings towards the end of this year. The Chinese consumer is also showing strength, having only recently emerged from lockdown. And then there are sectors like construction where longer lead-times and low inventories are, for now, masking the negative impact of higher rates. These countervailing, positive dynamics may persist for a while, but they are temporary by nature – a function of an economy catching up after an extraordinary setback. As a result, the full impact of a rising cost of capital on an indebted economy has yet to be revealed.

I’d like my money back

Following banks’ robust share price performance in 2022, we were asked more than once in January and February whether we might turn our attention to the sector. Our response was a quick and easy no. We aim to steer clear of highly levered businesses, particularly those where a company’s equity is dwarfed by its liabilities. Banks are perhaps the epitome of this. On top of being highly levered they also perform ‘maturity transformation’ – taking overnight customer deposits and converting them into multi-year loans, thereby borrowing ‘short’ and lending ‘long’. And it is a presumption of the permanence of deposits which can turn a precarious situation into an overnight disaster.

Much has been made of the mismanagement of SVB and the extension of its asset portfolio’s duration in 2021. This reach for yield at the apex of a bubble in which almost all investors had been ‘reaching’ for over a decade was ill-timed. Ultimately however, it was the nature of the deposit base that left SVB particularly exposed. Deposits and debt make up a bank’s liabilities, but depositors generally do not view themselves as lenders. That is, until it becomes clear their capital is at risk.

The risk of bank runs has been greatly reduced since the introduction of government deposit insurance schemes, in the US in the 1930s and in the UK in the 1970s. But the US limit of $250,000 was barely relevant in the context of SVB. The bank provided services to almost half of the US’s venture capital-backed businesses and, as such, took on much larger, uninsured deposits. With no safety net for these in place, a trickle of withdrawals soon became a wave as concerns over the bank’s liquidity caused the situation to escalate. This series of events is unlikely to herald a re-run of 2008. This is not only because SVB’s structure was unusual, but also because the US authorities have now stepped in to provide widespread liquidity to stem the bleeding.

It is likely that the long-term implications of these events are greater regulation, particularly of smaller banks. That will however do nothing to change the unavoidably levered nature of banks’ business model. When liabilities tower above equity, for any company, not much needs to happen to the value of the assets for that sliver of equity to be eroded. At Credit Suisse, this structure met with poor governance and a series of capital allocation errors. At the end of 2022, the bank had assets of CHF531bn and liabilities of CHF486bn. That left equity on the balance sheet of CHF45bn, valued by the market at just CHF11bn, down from a peak market capitalisation of CHF106bn in 2007. On March 19th, UBS agreed to buy the whole business for a price of CHF3.2bn. The bank collapses of SVB and Credit Suisse are a stark reminder of the inherent fragility of the fractional reserve banking business model[1]. It would be dangerous to assume these were isolated incidents. If previous financial crises are a guide, further accidents cannot be ruled out.

Anaesthesia wears off

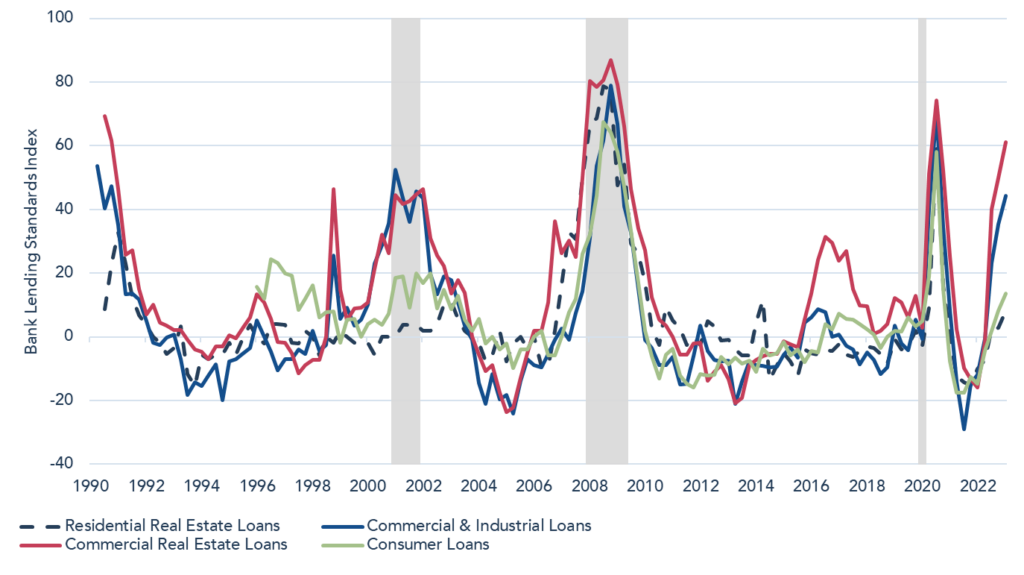

These banking failures also have important implications for the availability of credit. A decline in banks’ risk appetite will add to the impact already being felt from higher rates – a process which was already well underway at the start of the year (see Figure 1). This is a function not just of sentiment on the part of the banks themselves but also, and perhaps more importantly, of the vast sums of money which depositors are now withdrawing. Depositors were on the move as early as last April, marking the first time that bank deposits have declined since the 1960s. As at 20th March 2023, the Fed’s overnight lending rate was 4.75% but the average depositor in the US was earning 0.37% on their current accounts and 1.49% on one-year deposits. Money-market funds, made up of short-dated government securities and offering yields of over 4%, have been a natural destination for this capital.

Figure 1 – Bank Lending Standards

Source: Haver, JEF Economics, Troy Asset Management Limited, 31 March 2023. Past performance is not a guide to future performance.

Banks will have to pay depositors more to retain their deposits, and in turn protect profitability by charging more on their loans. That poses an immediate problem for certain sectors that depend on bank financing, while others will feel the effects over time. The US consumer is in a better position than it was on the eve of the Financial Crisis – debt servicing now accounts for less than 10% of average household incomes compared with c. 13% in 2008. Moreover, the largest component of household debt is mortgages, c. 90% of which pay a fixed rate versus c. 80% in 2007. It will take time for consumers to feel the pinch of higher rates. Many consumers are flush with cash (Figure 2), whilst unemployment is at a 64-year low. Both factors provide temporary relief and extend the cycle.

Figure 2 – Household Cash & Debt Service Costs

Source: Haver, JEF Economics, Troy Asset Management Limited, 31 March 2023. Past performance is not a guide to future performance.

Small businesses are more immediately vulnerable. Whereas large US businesses can access capital markets for funding, small companies borrow from banks, usually via floating-rate loans. They also have an outsized impact on the economy. There are 33 million small businesses in the US, which have accounted for over 75% of all job openings since the pandemic. As smaller companies struggle to access affordable capital, the ripple effects for the rest of the country will be felt at the same time that some of the post-pandemic anaesthesia is wearing off.

Another area of vulnerability is US commercial real estate. Here, leverage and rate sensitivity meet a reliance on bank lending, with small banks providing 70% of bank loans to the sector. The market is already pricing in the first order effects with commercial real estate prices falling double-digits year-on-year, the sharpest declines since the Financial Crisis.

Fighting the last war

Monetary policy is, at best, a blunt tool. In the current context it has become a sledgehammer, whose impact will be felt with an unhelpfully long delay.

The Federal Reserve got it wrong on inflation, allowing it to rip to generational highs. Inflation was ‘transitory’ until it was not – and now, in a bid to regain credibility, fighting inflation remains the top priority. That will remain the case until either inflation is back close to 2% or something else comes along which demands greater attention. The banking crisis has necessitated a gargantuan liquidity injection, counteracting four months of quantitative tightening in one week. But make no mistake, this plugs a gap, it doesn’t stimulate demand. When it comes to interest rate hikes, the Fed is holding firm even as the market expects a swift reversal. On 17th March, the 2-year Treasury yield saw the biggest one-day decline (-61bps) since 1982 and the market is now pricing in four rate cuts by January. So long as ordinary people are more worried about the cost of living than their employment status, we expect the Fed will continue to fight the inflation battle. For a change in tack, we suspect that Main Street and the consumer, not Wall Street, needs to be at risk. This likely requires a weaker labour market and it means that lower rates, when they come, will not be good news.

Equities are still hoping for a soft landing. The Nasdaq has cheered the prospect of lower yields, appreciating +15% year-to-date. In January’s Report we wrote about two ways to win in index-linked bonds; we fear there are two ways to lose in equities. If rates are going lower, most likely earnings are too. That is not factored into consensus estimates which for the S&P 500 are currently projecting flattish earnings growth for this year, and a return to strong growth for 2024. If rates remain at current levels because the economy is fine, equities should be pricing in a higher cost of capital. Valuations at a market aggregate level are above historical averages, and the same is true of the majority of excellent businesses in our Investment Universe.

What does this all mean for inflation? In the near term, it is likely that inflation continues to moderate. Nothing about credit contraction spells higher growth or higher prices. But longer-term, we expect that many of the inflationary behaviours of the past two years are here to stay, both in terms of labour’s bargaining power and in terms of the fiscal support provided by governments. Our index-linked bonds will do well if real yields fall and, as set out in last quarter’s Report, this can happen in one of two ways. Either nominal yields fall, or inflation expectations rise. It seems more likely now that lower nominal yields will be what continues to drive real yields lower in the short term.

Investing blindfolded

A Financial Times columnist recently conducted an experiment to assess Open AI’s Chat GPT-4 against Google’s Bard. One of several tasks set was a stock picking contest, revealing the ‘very human’ tendencies of both chatbots to back past winners. Each picked stocks which had done well in 2021 (the most recent data set for Chat GPT). This is hardly surprising since the output of Artificial Intelligence is only as good as its inputs, and both chatbots were likely focusing on share price performance, not qualitative analysis.

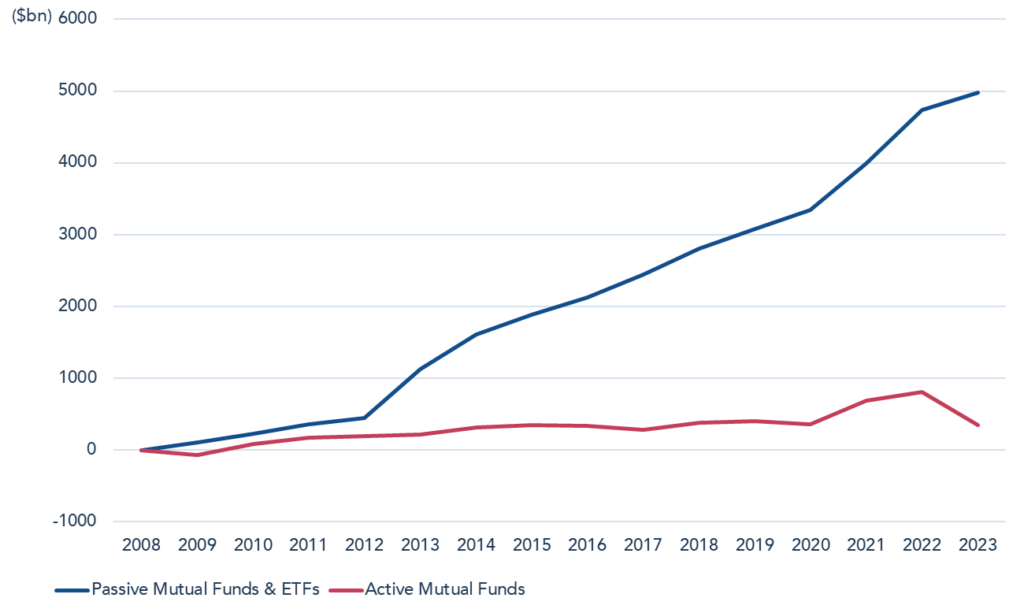

This behaviour is not so different from that of investors. We observe that since the market last experienced a sustained downturn, both passive investment vehicles and quantitative trading strategies have increased their share of asset flows (see Figure 3). Whether algorithmically driven, in the case of hedge funds with systematic trading strategies, or retail investors buying ETFs, each approach has a strong bias towards momentum investing. The focus is on day-to-day price action, not the fundamental performance of underlying businesses and the value accorded to their future cashflows.

Figure 3 – Cumulative Passive & Active Equity Flows ($bn)

Source: Troy Asset Management Limited, Lipper, Factset, 31 March 2023. Past performance is not a guide to future performance.

This makes for a faceless market – one which has been value-insensitive on the way up, and which is likely to be value-insensitive on the way down. It also creates a market where the pendulum can swing too far both ways, creating volatility. As GMO’s Jeremy Grantham notes ‘volatility is a symptom that people have no clue of the underlying value.’ That is an opportunity for those of us who take the time to deeply understand the drivers of long-term wealth creation.

Patience is a virtue

Wherever we look upon this earth, the opportunities take shape within the problems.

Nelson A. Rockefeller, Former Vice President of the United States

We do not expect 2023 to offer sudden clarity, nor do we expect the unravelling of high valuation multiples to occur overnight. The short, sharp bear market of 2020 will likely prove an unhelpful precedent for those looking to navigate the months ahead. We have had a protracted upcycle so it follows that we may have a protracted downturn as markets adjust to a world in which money is no longer free. The uneven nature of the post-COVID recovery brings further complexity and the bright spots for growth mentioned in this Report may support the prevailing optimism further into the year. We expect it will take a decline in earnings and a recession for equity investors to fully reappraise the valuations they are willing to pay.

In the meantime, investors in the Trust are being paid to wait. We have actively reduced our equity allocation over the past two years, to a level which is currently just above 20%. This is the lowest allocation the Trust has had since 2008. Meanwhile, the 30% of the Trust invested in ‘liquidity’ is largely assigned to short-dated US and UK government bonds that are now delivering respectable nominal returns. A continued focus on resilient businesses, and discipline on valuation, should guide us through the next phase of this bear market. Being able to thoroughly understand what we own, or want to own, is clarifying when the outlook is so murky. This was the case during the pandemic, and it was the case in the Financial Crisis; during both periods the Trust materially increased its equity exposure. We are not there yet, but we are poised to act when the time arrives.

[1] The fractional reserve banking concept was established in Renaissance Italy. The idea posits that banks need to retain only a small proportion of deposits they collect from customers since depositors will rarely try to get all their money back at the same time

Please refer to Troy’s Glossary of Investment terms here. Performance data provided relating to the NAV is calculated net of fees

with income reinvested unless stated otherwise. Overseas investments may be affected by movements in currency exchange rates.

The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The

historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown.

It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels

of relief from taxation can change at any time. Any change in the tax status of a Trust or in tax legislation could affect the value of

the investments held by the Trust or its ability to provide returns to its investors. The yield is not guaranteed and will fluctuate. There

is no guarantee that the objective of the investments will be met. Shares in an Investment Trust are listed on the London Stock

Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to

provide discretionary investment management services and should not be used as the basis of any investment decision. Any

decision to invest should be based on information contained within the Prospectus, Investor disclosure document the relevant key

information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable

for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser.

References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation

to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to

be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this

document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be

subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings

from independent rating agencies should not be taken as a recommendation.

Please note that Personal Assets Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2023. ‘FTSE ®’ is a trademark

of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street,

London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S.

Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply

a certain level of skill or training.

© Troy Asset Management Limited 2023